As of the year 2018, the gender overall earning gap in the European Union stands at 36.7%. This comprehensive statistic combines average hourly earnings, the monthly averages of the number of hours paid, and the employment rates from across the EU. It is indisputable that an appalling gap remains between the overall earnings of men and women. Nevertheless, women continue to carry the burden of paying for the so-called “Pink Tax,” a general increase in the price of goods and services marketed to women across the globe.

The pink tax is not a tax in the literal sense. Rather, it is a consistent markup on items targeted towards women which men do not have to pay as much for, despite them being the same caliber of product or service.

The phenomenon occurs across a wide variety of sectors, affecting children as much as grown adults. A United States government study found damning evidence proving the unequal economic burden that women must bear, just for being a woman and in addition to gender wage gaps:

- Toys marketed towards girls cost more 55% of the time, while toys marketed towards boys cost more only 8% of the time

- Personal care products marketed towards women cost more 56% of the time, while those marketed to men cost more 13% of the time

- Senior home health care products for women cost more 45% of the time, and cost more for men 13% of the time

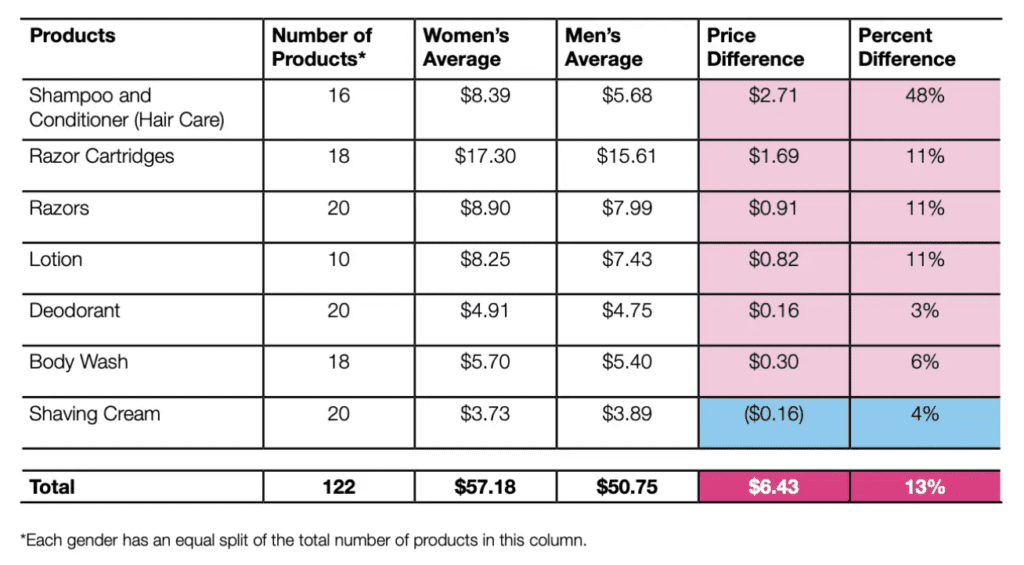

To better understand how this tax materializes in real-life, refer to the table below composed of data found in the aforementioned US government study:

This issue is not unique to the US. A study in the United Kingdom found that women’s toiletry items are on average more expensive than men’s, including a 34.28% markup on facial moisturizer. Countries like Japan and Canada found that gender price discrepancies occur more than 50% of the time.

The worst part is, many of these products do not need to be gendered. So, the issue goes deeper than merely the price differences, as it also actively reinstates gender stereotypes. Women are marketed the flower-scented soap, for instance, and are looked down upon or seen as strange if they buy the cheaper male option with sandalwood scent, for example. Many people try to play the Devil’s Advocate when it comes to the topic of the Pink Tax, twisting the narrative to say that if women had such an issue with the prices of goods marketed towards them, then they should just buy men’s products. However, the argument is demeaning and completely misses the point, blaming the victims of such unfair costs imposed and not the system that consistently reiterates such discrepancies.

This hindrance adds up to cost women thousands of dollars per year, amounting to significant sums of money throughout their lifetime. Even more burdened by this discriminatory cost scheme tend to be women of color, whose wage gap between men remains even higher than the gap between men and white women. For example, findings from the 2020 report by the United States Bureau of Labor Statistics show that, on average, Black women only made $0.64 for every dollar a white man makes, and Latina women only made $0.57 for each dollar a white man makes. While this points out the heightened difficulties for women from these backgrounds to pay the burden of the Pink Tax, there is still more to the story. Oftentimes these women are charged even more for basic services like haircuts than white women, who are already paying more than men.

I mentioned before that the Pink tax is not a tax in the literal sense. But if that is the case, what is the economic explanation for the existence of the Pink Tax? Import tariffs.

Companies must pay higher import tariffs in general on women’s products. A 2020 study published in the American Political Science Review investigated 167 countries throughout a 20-year span to examine tariffs on both men’s and women’s apparel. Its findings state that nearly 40% of the same products for men versus women have tariff differentials.

The issue of such high tariffs could be rectified by increasing women’s representation in the legislature, the study found. With the global rate of women’s congressional representation standing at 26.1%, there is immense work to be done in order to address the issue of the Pink Tax. Unfortunately, men do not have the same incentives to advocate for women in this realm, and most efforts to combat the gender-based tax have been shut down.

Politicians should view places like California as an example. In the State, it has been illegal to introduce gender-based pricing on consumer services, including haircuts and dry-cleaning, with the Gender Tax Repeal Act. However, this does not eliminate the Pink Tax on products, and legislation at the federal level of the United States has yet to pass despite efforts to do so.

As a woman, avoiding the Pink Tax is difficult to navigate. It feels blatantly unfair that we have to actively avoid paying extra for essential products and services, and trying to avoid them can seem like more trouble than it’s worth. Needless to say, the continuous additional prices that we are forced to pay are infuriating, as it adds up to potentially millions of euros over a lifetime.

A way to combat the Pink Tax is to support companies that apply gender-neutral pricing or try to buy gender-neutral products when possible. A more effective way to do this is through voting for officials who will bring forward and/or support a stop to the Pink Tax, namely women. It is clear that there needs to be more female representation in government for change as such to come.

There is an exhaustless list of issues in the world, many of which stem from gender-based discrepancies. Let’s take the initiative to support the abolishment of the Pink Tax, the price we pay to be a woman.

Featured image by: Shutterstock